An act of 1754 changed the law on banking. It restricted banks were to organisations of six partners or less, and prohibited merchants from engaging in banking. This had the effect of largely excluding merchant funds from banking.

The Bank of Ireland was founded in 1783 by Royal Charter with special privileges as a large private joint stock bank. It was the only bank in Ireland with more than 6 partners, and was located in a single premises in Dublin.

Many Irish private banks came and went. Most failed in various crises, the most important of these in terms of economic damage were the failures of Ffrench's Bank, Tuam (1814); Maunsell's, Limerick (1820); Robert's and Leslie, Cork (1820-1826). The failures of these banks undermined other banks in their region as well as causing economic distress and a reduction in money supply.

Some private banks were very prosperous. A few flourished for over a century, the most well-known of them being La Touche, and Beresford's (later BHall's Bank), both in Dublin; and Pike's Bank in Cork.

Other private banks were small issuers and merchants who simply stopped issuing notes and closed in an orderly manner. Examples of these are Denis Moylan in Cork; Boyle's Bank in Dublin; and a much larger enterprise, John Ewing and Co. in Belfast which closed in 1797 after a very successful decade in business.

A few private banks have the reputation of merely being in business to issue notes, only to close after a short period of operation leaving a large amount of unpaid notes outstanding. O'Neill's in Waterford; and the Malahide Bank, later Silver Bank (Malahide) are two such banks which failed leaving unpaid debts.

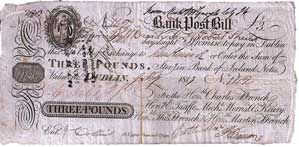

Examples of notes prior to around 1800 are rare.

<BACK - NEXT>