Other note-issuing banks and businesses also existed, and will be added here when examples of their notes turn up for illustration.

Last updated: 06.08.23. Latest addition of banks: 05.01.22.

29 Bank pages listed. 8 Bank pages in preparation.

This page is under active revision: Rewriting. Addition of further detailed references, with urls where available.

The Private Bank pages are under constant revision. Banks listed above in black have yet to be added here. There are threads on the Private Banks Discussion Forum on some of the banks which have not yet been added to this section. Banks are being added here on an on-going basis once there is sufficient data on them to warrant a page, and their label colour is then changed appropriately.

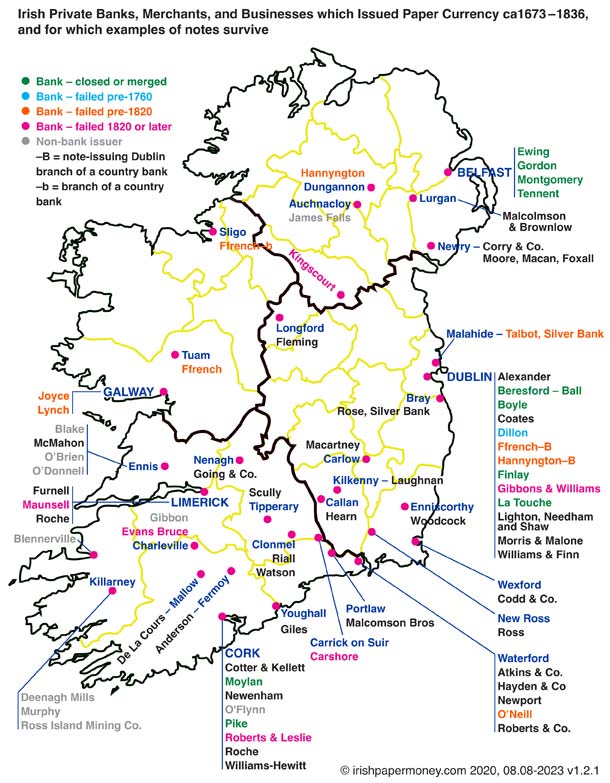

There were well over a hundred note-issuing Private banks and businesses in the era of the Irish private banks of note issue, which spanned about 150 years. Almost all of the surviving banknote and post bill [13] issues of the Irish private banks date from the period 1797 to 1837, with a few rare exceptions dating from the earlier 1700s.

The suspension of cash payments [8] on 27 February 1797, when paper currency ceased to be payable in gold due to England’s need for gold to finance its wars on the continent, gave a boost to banking and banknote usage in Ireland.

A lack of coinage, lead to a need for a credit finance system in its place. This in turn led to the growth of private banks, in particular those which issued banknotes and post bills. All Irish banks were permitted to issue their own currency notes.

There were several boom and bust cycles involving banking in Ireland in the 130 year era of the private banks up to 1824.

Private banks were prohibited by law from having more than six partners [2. Barrow (1975), p.11] by the Bank of Ireland Act of 1781 [24], which provided for the creation of the Bank of Ireland, a private joint stock bank established in 1783,. Additionally, the 1756 act required all of the partners of the bank to be named on every note and receipt, and prohibited bankers from engaging in other business which involved imported or exported goods, thus largely excluding merchant capital from banking.

These constraints kept the banks weak, and also defined the banknotes issued by the Private banks, which list the partners of the issuing bank, except sometimes when a sole banker was operating. Many of the Private banks had little in the way of backing for their banknote issues and a lot of them tended to over-issue notes. Many of them failed after a few years in business.

The Irish Banking Act of 1825 which enabled the formation of public Joint Stock banks also sealed the fate of note-issuing private banks, by providing a stable well-funded banknote issue which made the note issues of the private banks less desirable and less necessary.

The small number of note-issuing private banks which survived into the era of joint Stock banking were taken over by joint stock banks, or merged with other private banks to form joint stock banks. By around 1836 there were no private banks remaining which issued banknotes.

The Bankers (Ireland) Act 1845 [21] prohibited the granting of the right of note issue to any bank that did not already have it, terminating the era of Irish private banks of note issue.

For a background history on the Irish Private banks, The history of Banking in Ireland by J W Gilbart [4] is a good resource.

This section on the Private Banks is a work in progress, and will grow as banks are added.

The study of the Irish private banks has progressed gradually since the 1970s. The largest contributors to the current knowledge on the banknotes of these banks are Young (Irish Numismatics, 1968-1986), Gallagher (Small Notes), Callaway (Paper Money of Ireland, 2009, 2022), and Kenny & Turner (2019) [7].

There is also a broader background of published material on the private banks in general and of the banking system they were a part of in the form of articles, papers and books dating from the nineteenth century right up to the present day. A list of the papers and articles most relevant to the study of the banknotes is in the references at the bottom of this page.

New discoveries in banknotes are turning up constantly, as is new information on the banks themselves.

In June 1701 the value of the Irish Pound was fixed by Proclamation at a rate of 13 pence Irish to 1 British shilling [2. Barrow (1975), p.25; 6. Honohan, 2002], with a later proclamation of 29 September 1837 fixing the English Guinea at 22s 9d Irish [3A. Dillon (1889), p.12]. This rate was in place until the Assimilation of Currencies Act, 1825 abolished the Irish Pound from 6 January 1826, and made sterling the currency in Ireland [2. Barrow (1975), p.28].

As the notes issued by banks were ultimately payable in specie - gold coin - the denominations on many Irish notes issued up to 1826 stated the Irish Pound equivalent of certain Guinea denominations. This lead to various odd denominations of Irish currency being listed on notes.

Banknotes payable on demand to the bearer, were printed by various printers. Notes of two banks are known to have been printed on both sides, those of all other banks being printed uniface. They varied in design, shape and size.

Denominations used were varied, and often tended to be small notes below £5 in face value, and for amounts which corresponded to coin denominations. The vast majority of banknotes recorded are for denominations less than £10, although higher denominations up to £100 are known - a £100 note of Ffrench's Bank is in the National Museum of Ireland.

Contemporary forgeries are sometimes encountered. These are generally faithful to the design of genuine notes and provide insights into bank partnerships. They are also highly collectable.

As far as it is known, no private bank ever issued a note with adenominaion of 10 shillings. The first known instance of an Irish 10 shilling note being printed was during the general strike of April 1919 in Limerick when the strike committee produced its 'treasury notes', which became known as the 'Limerick Soviet notes'. In 1928 the Currency Commission Irish Free State issued 10 shilling notes as part of the new Legal Tender Note series.

Bank post bills [13] were issued by many of the private banks and became a significant element of circulating currency. Post Bills were designed to transmit money through the post and were payable after a specified amount of time for security reasons, from 7 to 21 days after issue. The design of the Post Bills of the banks is very similar to those of their banknotes and as such they are highly collectable.

It is notable that the Bank of Ireland also issued post bills, and was the only joint stock bank known to do so.

Some of the more common fractional denominations in use on currency notes issued by Irish private banks are listed below. Many corresponded to Guinea denominations in use. Various whole Shilling denominations were also produced, 9s and 6s being the most commonly used.

One Pound, 5 Shillings = 25 Shillings

3 Shillings, 9 and a half pence Irish = 1/6 Guinea

7 Shillings, 7 pence = 1/3 Guinea

1 Pound, 2 Shillings and 9 pence Irish = 1 Guinea

1 Pound, 14 Shillings, 1 and a half pence Irish = 1.5 Guineas

Five Pounds, Thirteen Shillings and Ninepence Irish = 5 Guineas

Notes denominated in Guineas almost always also stated their Irish currency equivalent.

11⁄2d on a note under 3 Guineas in face value.

3d on a note under £10 in face value.

4d on a note under £50 in face value.

Banks issued notes in Pounds Sterling, and notes in Irish Pounds. Notes with a primary denomination in Guineas (1 Guinea = 21 Shillings Sterling) often but not always stated their denomination in Irish currency. Sterling notes were identified as such with the word 'Sterling' or 'British'.

Post bills circulated as currency, but were only redeemable a stated number of days after issue which could be up to 21 days. The term 'sola bill' is occasionally stated, meaning a single individual bill.

Sight notes, or sight bills are very similar in nature to post bills, in that they promise to pay after a certain period. In the case of the sight note, payment is promised on a certain stated time period after the note is presented for payment.

Only those Private Banks which are known to have issued notes, and for which examples of those notes are available are listed. Non note-issuing banks are outside the scope of this listing at present.

The listing of 'banks' will include merchants who issued notes who did not describe themselves as bankers and did not register as such.

All banknotes are displayed in correct proportional size to each other where possible. If the correct size of a banknote is not known this is stated with the image.

Most of the images have been sourced from the net over the past decade, with some being loaned by collectors for scanning. Some images were obtained up to 20 or more years ago. As a result, the quality of available images varies. Upgrades are welcome, as are images of banknotes not pictured on the web site. The majority of images are from Whyte's Dublin auctions and Noonan's Mayfair, London with a few from Spink, London. These three auctioneers have handled the vast majority of notes issued by private banks which have come to the market, and continue to do so.

Linked pages and examples of banknotes of all of the banks in this list will be added on a phased basis. The information contained in these listings is being researched constantly, and will be added to periodically. Advice of updates will be posted on the web board.

Alexander & Co. Dublin 1810-1820.

Atkins, Skottowe, Roberts. Waterford Bank. 1806-1809.

Beresfords Bank, later Balls Bank, Dublin. 1793-1888

Peter Blake, Ennis, Co. Clare. 1813-1816

Boyle & Co. Dublin. 1833

Carshore. Carrick on Suir, Co. Tipperary. 1806-1809

Cotter & Kellett's. Cork Bank. 1800-1809.

De La Cours. Mallow Bank. 1801-1835.

Dillon & Co. Dublin. 1736-1754

Evans Bruce, Charleville. 1803-1820

Ewing & Co., Belfast Bank. 1787-1797

Fermoy Bank. 1800-1816.

Ffrench's Bank. Tuam, Co. Galway and Dublin. 1803-1814 (Also known as Tuam Bank) Failed due to lack of liquidity.

Finlay's Bank. Dublin. 1754-1829

Fleming, Cunningham Gouldsbury. Longford Bank. 1804-1808.

Gibbons and Williams. Dublin. 1833-1835

Gordon and Co. Belfast Bank. 1808-1827 Merged with Tennent & Co., Belfast Commercial Bank in 1827 to form the Belfast Banking Company, a joint stock bank.

Hughes, Drogheda. 1804.

Hannyngton, Dungannon, Co. Tyrone and Dublin. 1803-1816.

Joyce & Co. Galway Bank. 1802-1813.

Bank of Kingscourt, Co. Cavan. 1805-1809

La Touche & Co., Dublin. 1693-1870. Merged into the joint stock Munster Bank.

Laughnan. Kilkenny Bank. 1816-1820.

Leslie's. Cork Bank. 1823-1825

Lighton, Needham and Shaw. Dublin. 1797-1805.

Lynch & Co. Galway Bank. 1805-1814

Macartney, Carlow Bank. 1804-1813.

Talbot's, Malahide Bank, later Talbot's Silver Bank. 1803-1804

Maunsell, George & Co. Bank of Limerick. 1815-1820

Montgomery and Co. The Northern Bank. 1809-1824

Moore, Macan, Foxall. Newry Bank. 1804-1816.

Moylan, Cork. 1813-1814

Newports. Waterford Bank. 1799-1820.

O'Neill's Bank, Waterford. 1799-1801

Pike's Bank, Cork. 1800-1826

Rialls Bank. Clonmel, Co.Tipperary. 1802-1820.

Roberts, Leslie. Cork Bank. 1799-1825

Roberts, Roberts, Congreve. Waterford Bank. 1807-1809.

Roche's Bank. Cork. 1800-1820.

Roche's Bank. Limerick Bank. 1801-1825.

The Silver Bank. 1804, Alderman John Rose.

Ross’ Bank. New Ross, Wexford. 1800.

Shaw’s Bank. Dublin. 1805-1836.

Solomon Watson & Co. Clonmel Bank. 1800-1809.

Tennent and Co. Belfast Commercial Bank. 1809-1827 Merged with Gordon & Co., Belfast Bank in 1827 to form the Belfast Banking Company, a joint stock bank.

Williams & Finn. Dublin. 1804-1806.

William Williams-Hewitt & Co. Cork. ca.1776-1787.

Belfast, Co Antrim

David Gordon and Co. Belfast Bank. 1809-1827

Ewing & Co., Belfast Bank. 1787-1797

Hugh Montgomery and Co. The Northern Bank. 1809-1824

William Tennent and Co., Belfast Commercial Bank. 1809-1827

Carlow

Henry Macartney, Carlow Bank. 1804-1813.

Cavan

Carrick on Suir, Co. Tipperary

Charleville, Co. Cork

Evans Bruce, Charleville. 1803-1820

Cork

Cotter & Kellett's. Cork Bank. 1800-1809.

Leslie's. Cork Bank. 1823-1825

Moylan. 1813-1814

Pike's Cork Bank. 1800-1826

Roberts, Leslie. Cork Bank. 1799-1815

Roche's Cork Bank. 1800-1820.

Williams-Hewitt & Co. Cork ca.1776-1787.

Clonmel, Co. Tipperary

Riall's Bank. Clonmel. 1802-1820.

Watson & Co. Clonmel Bank. 1800-1809.

Dublin

Alexander & Co. Dublin 1810-1820

Beresfords Bank, later Balls Bank, Dublin. 1793-1888

Boyle & Co. Dublin. 1833

Dillon & Co. Dublin. 1736-1754.

Ffrench's Bank. Charles and Co. Dublin. 1807-1814

Finlay's Bank. Dublin. 1754-1829

Gibbons and Williams. Dublin. 1833-1835

Lighton, Needham and Shaw. Dublin. 1797-1805.

Shaw’s Bank. Dublin. 1805-1836.

Talbot, The Silver Bank. 1803-1804

Williams & Finn. Dublin. 1804-1806.

Dungannon, Co. Tyrone

Hannyngton, Dungannon, Co. Tyrone and Dublin

Ennis, Co. Clare

Peter Blake 1813-1816

Francis McMahon 1805-1816

Michael O'Brien ca1811

John O'Donnell 1819

Ennis Chronicle ca1784-1831

Drogheda, Co. Louth

William Hughes. 1804.

Fermoy, Co. Cork

Fermoy Bank. 1800-1816.

Galway

Ffrench's Bank. Charles and Co. Tuam, Co. Galway. 1803-1814 (Also known as Tuam Bank).

Joyce & Co. Galway Bank. 1802-1813.

Lynch & Co. Galway Bank. 1805-1814.

Kilkenny

Laughnan. Kilkenny Bank. 1816-1820.

Limerick

Maunsell, George & Co. Bank of Limerick. 1815-1820

Roche & Co. Limerick Bank 1801-1825.

Longford

Fleming, Cunningham Gouldsbury. Longford Bank. 1804-1808.

Newry, Co Down

Moore, Macan, Foxall. Newry Bank. 1804-1816.

Mallow, Co. Cork

De La Cours. Mallow Bank. 1801-1835.

Waterford

Atkins, Skottowe, Roberts. Waterford Bank. 1806-1809.

Newports. Waterford Bank. 1799-1820.

O'Neill's Bank, Waterford. 1799-1801

Roberts, Roberts, Congreve. Waterford Bank.1807-1809.

Wicklow

Wexford

Ross’ Bank. New Ross. 1800.

Our research on the Irish Private banks continues constantly. A small steady trickle of newly recorded notes adds to the story.

Most of the new information on the background of the issuers of notes comes from literature searches on the internet.

There is also a wealth of information on old Irish money of the Private banks to be found in Irish Numismatics Magazine (1968 - 1983) by Derek Young in his sections titled, ‘The Private Banks and their Notes’, as well as older reference material. Additionally, there is information and images of many important notes in ‘Paper Money of Ireland’.

References used in the private banks pages on this website are listed at the end of each bank page. Further references and reading resources are added on an ongoing basis as they are discovered, along with background information on the individuals behind the Irish private banks. Many of these early bankers were prominent members of society.

General References

Images of banknotes on this website of the Irish Private Banks are from the following sources, as noted under each image on the picture pages: Central Bank of Ireland; private collections (uncredited); auction catalogues: Noonan's (DNW), London, Spink, London, Whytes, Dublin.

1. Barrow, G. L. (1972). 'Some Dublin Private Banks' Dublin Historical Record Vol. 25, No. 2 (Mar., 1972), pp. 38-53.

2. Barrow, G. L. (1975). 'The Emergence of the Irish Banking System 1820-1845', Gill & Macmillan.

3. Callaway, J. (2022). 'Papermoney of Ireland', 2nd Ed.

Cullen, L. M. (1983). 'Landlords, bankers and merchants: the early Irish banking world, 1700-1820'. Hermathena, 135, 25–44. https://www.jstor.org/stable/23040820

4. Gilbart, J. W. 'The history of Banking in Ireland', 1804, Longman, 1836.

5. Hall, F. G. (1949). 'The Bank of Ireland, 1783-1946'. Dublin: Hodges, Figgis and Company.

6. Honohan, P. (2002). 'Using Other People’s Money: Farewell to the Irish Pound', History Ireland.

7. Kenny, S., Turner, J. D. (2019). 'Wildcat bankers or political failure? The Irish financial pantomime, 1797-1826', European Review of Economic History 24(4).

8. Newby, E. (2007). 'The Suspension of Cash Payments as a Monetary Regime', University of St Andrews.

9. O’Brien, N., 'The Road to an Irish national bank'.

10. Ó Gráda, C. (2001). 'Should the Munster Bank have been saved?', Dept. Economics, University College Dublin, Working Paper Article.

11. O’Kelly, E. (1959). 'The Old Private Banks and Bankers of Munster'. Cork: Cork University Press.

12. Ollerenshaw, P. (1987). 'Banking in Nineteenth Century Ireland'. Manchester: Manchester University Press.

13. Symes, P., 'Bank Post Bills and Post Notes'. www.pjsymes.com.au/articles/PostNotes.htm

14. Tenison, C. M. (1893-1895). 'The Old Dublin Bankers.' Journal of the Cork Historical and Archaeological Society, No. 2-3.

15. Tenison, C. M. (1892, 1893). 'The Private Bankers of Cork and the South of Ireland.' Journal of the Cork Historical and Archaeological Society, No. 1-2.

16. Young, D. (1968-1986). Irish Numismatics Magazine.

17. Report, Minutes of Evidence, and Appendix, from the Committee on the Circulating Paper, the Specie, and the Current Coin of Ireland; and also, on the Exchange between that Part of the United Kingdom and Great Britain [May and June 1804], House of Commons, 1826. https://archive.org/details/op1244312-1001

18. Walsh, P. (2014). 'The South Sea Bubble and Ireland: Money, Banking and Investment, 1690-1721'. Boydell Press, Woodbridge, UK.

19. A brief on the Assimilation of Currencies Act, 1825.

20. 1844 Bank Charter Act <https://www.legislation.gov.uk/ukpga/Vict/7-8/32/contents/enacted>

21.Bankers (Ireland) Act 1845 <https://www.irishstatutebook.ie/eli/1845/act/37/enacted/en/print>

22. The Bank of Ireland Act 1781

<https://www.irishstatutebook.ie/eli/1781/act/16/enacted/en/print.html> [Last accessed 13.10.22]

![]()

![]()

The Private banks page is actively having banks added to it. As long as there remain banks to be added for which notes were issued, the graphic below will remain!