This bank was founded in 1786 by Sir Thomas Roberts in Cork as Roberts & Co. Located St Patrick’s Street in the centre of Cork city, the bank grew steadily to become one of the more important banks in the Cork region.

The second partnership was registered on 29 March 1799. This registration brought in John Leslie as a partner for the first time. The bank also became known as Leslie & Co. Leslie’s became one of the more important banks in the south of Ireland.

The bank went through a number of partnership changes, with Sir Walter Roberts, son of Sir Thomas becoming lead partner in 1815 after the death of Sir Thomas in 1814.

Sir Walter Roberts retired from the bank in 1819. This left the Leslie brothers as sole partners in the bank. Charles Henry Leslie became lead partner with John Leslie as the second partner.

Leslie's bank suspended payments on its notes and closed on 25 May 1820 during the 1820 crisis as a result of the panic surrounding the failure on that day of Roche’s, one of the largest banks in the south of the country at that time [1. O'Kelly, 1959]. A committee of creditors investigated Leslie's and found that the bank’s balance sheet was in poor shape. It remained closed.

Relaunch in 1822 after two years of closure

The bank received a government loan of £80,000 from a Loan Commission established to provide relief after the 1820 crisis. The loan was secured as a result of backing from some local guarantors lead by Lord Shannon who was John Leslie’s wife’s brother in law. This enabled the bank to reopen in 1822.

The bank never regained public confidence, and closed again in 1826 when Pike’s Bank, Cork was closed and its business wound down. The closure of Pike’s resulted in a run on Leslie’s Bank which was in a fragile state at the time. The debts of Leslie’s bank were left largely unpaid as £50,000 remaining of the government loan had to be repaid first, leaving little for other debts.

The estates of the two Leslie brothers were sold in 1828 to provide funds towards their bank’s debts.

A rate of 50% in the Pound was the estimate in 1827 for the payment of the bank’s debts. It is not known what the final actual degree of repayment was. There was resentment from some at the failure of the guarantors to repay the government loan, Lord Shannon was the only one who offered to do so.

Robert's, and later Leslie's Cork Bank was an important note-issuing bank in the south east of Ireland in the early 1800s.

There are nine Series of banknotes recorded for the Bank by design, and five Types by partnership as set out in the table below.

Series 1-4. Sir Thomas Roberts & Co., Cork Bank. 1786-1815.

Series 5. Walter Roberts & Co., Cork Bank 1815-1819.

Series 6-9. Charles Henry Leslie & Co., Cork Bank. 1822-1826.

Five Types by partnership.

Type A. 1786-1799. Sir Thomas Roberts, James Chatterton, James Bonwell, Robert Travers, Thomas Roberts.

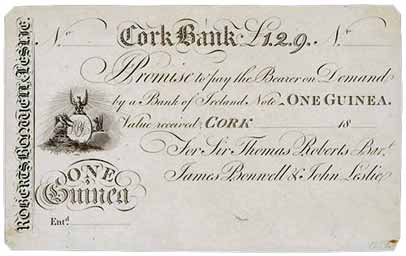

Type B. 1799-1810. Sir Thomas Roberts, James Bonwell, John Leslie.

Type C. 1810-1815. Sir Thomas Roberts, Walter Roberts, Charles Henry Leslie, John Leslie

Type D. 1815-1819. Sir Walter Roberts, Charles Henry Leslie, John Leslie.

Type E. 1822-1826. Charles Henry Leslie, John Leslie. The spelling of the two partners' names varied, with three variations across four note designs.

A range of major design variations exist, with each series being of a different design.

Three major variations of banknote issues known for Roberts and Leslie, Cork Bank

Series 1. Type A

No images available. Images sought

Series 2. Type B

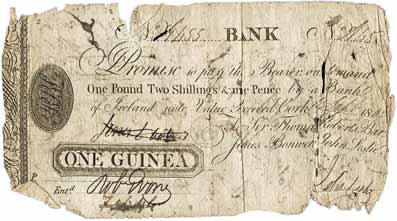

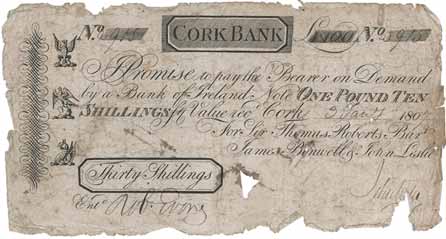

Series 3. Type B

Series 4. Type C

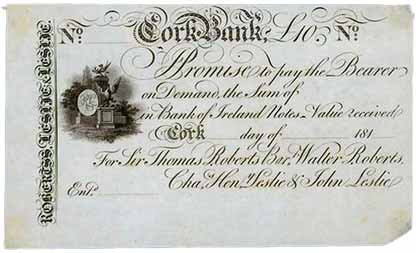

Series 5. Type D

No images available. Images sought

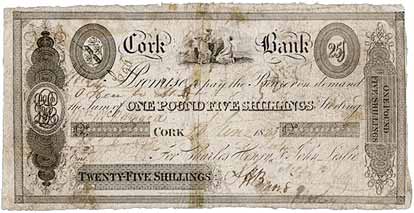

Series 6. Type E. Pounds Sterling

Series 7. Type E. Pounds Sterling

Series 8, Type E. Pounds Sterling

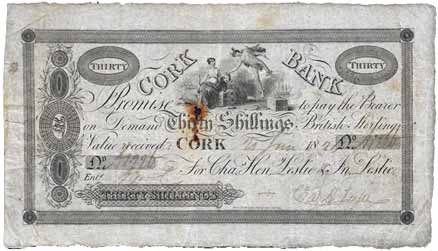

Series 9, Type E. Pounds British

Banknotes

All banknotes were printed uniface. Dating and numbering was carried out by hand.

An examination of surviving £1 notes indicates that the serial numbers were reset at the start of each of the four series of notes produced under partnership Type E, Charles Leslie and John Leslie. A serial number of up to four digits was used on banknotes, with the use of a single letter prefix as each serial number reached its maximum. The highest number seen on a note is 5694.

£1 note dated 22nd February 1823 (Series 7) has serial number A1359, £1 note dated 20th October 1823 (Series 8) has serial number 337. £1 note dated 1st October 1824 (Series 8) has serial number B1713, £1 note dated 24th October 1825 (Series 9) has serial number 882. These four notes are illustrated in the Charles Henry Leslie & Co., Cork Bank image gallery.

A similar system of numbering may have been used on earlier Series of the bank’s notes, though far too few issued examples have been seen to make a determination on this.

No examples of Series 1 or Series 5 notes are available for study currently.

Series 2, 3 and 4 are all distinct designs. Very few notes are available for study. The notes were stated as being payable in ‘Bank of Ireland’ notes. Banknotes of Series 6-9 dropped the reference to Bank of Ireland notes, and included ’Sterling’ instead after the value in words.

Series 6 of the note issues was the latest issue at the time of the bank’s closure in 1820. The style of these notes is in line with the design used for earlier partnerships with the surnames of the partners in scrolling text on the left hand side of the note. As there are notes extant of this series dated as late as 1825, it appears that the issue of this note design resumed after the bank reopened in 1822, presumably until stocks were used up.

Series 7. This new design of notes appears to have been created on the occasion of the reopening of the bank in 1822 after it had received the government loan. The banknotes are of a more modern framed design.

Series 8. A design change, similar to that or Series 7, but with text ‘Value received’ added after “Sterling’, and Cork centered. The spelling of the partners’ names has also been adjusted. Serial numbers were reset on Series 8 notes.

Series 9. The motivation for this design change probably relates to the abolition of the Irish currency under the Assimilation of Currencies Act, 1825. Barrow's Book 'The Emergence of the Irish Banking System' states: 'Notes and post bills were always denominated in Irish currency until just before the assimilation. The word 'sterling', commonly added after the amount, did not indicate British currency but seems to have been no more than a promise of sound value. When British currency was intended, as in bills or promissory notes payable in London, the words 'British sterling' were used'.

The bank's symbol, or 'logo' varied considerably on its notes throughout its 40 year existence.

References

1. O’Kelly, E. (1959). The Old Private Banks and Bankers of Munster. Cork: Cork University Press, pp. 61-79.

2. Images: Auction Catalogue, Noonan's (DNW), London. Important Collection of Irish Paper Money formed by Bob Blake (Part I),Noonan's (DNW), 2 Oct 2008.

3. Auction Catalogue, Noonan's (DNW), London. Important British, Scottish and World Paper Money, 2 Oct 2008.

3. Auction Catalogue, Noonan's (DNW), London. Important Collection of Irish Paper Money formed by Bob Blake (Part II), 14 March 2009.

5. Auction Catalogue, Noonan's (DNW), London. Important British, Irish and World Banknotes, 20 June 2006.

6. Auction Catalogue, Noonan's (DNW), London. Irish Banknotes, 12 March 2020.