Continue to a pictorial Historical Timeline of Irish Paper Money - 28 Pages

This page is under active revision: Rewriting. Addition of detailed references, with urls where available. Last revision: 22.03.23.

Banks first appeared in Ireland towards the end of the 17th century. The first known reference to a bank in Irish law was in an act passed by the Irish Parliament in 1709 (8 Anne, c.11) [9. Share 1979, p. 15], entitled 'An Act for the better Payment of Inland Bills of Exchange, and making Promissory Notes more obligatory' [10. Smyth 1849, p. 328]. The act permitted bills of exchange to be made payable to the bearer rather than to a named individual by declaring that 'notes issued by any banker, goldsmith, merchant, or trader, whether made payable to bearer or order, should be assignable and transferable by delivery or endorsement' [11. Walsh 2014, p. 49]. The 1709 Act received Royal Assent on 30 Aug 1709 [29. 8 Anne, c.11].

The Irish economy had great restrictions placed upon it by the English government in the late 18th and early 19th centuries. Ireland had a deflationary economy during this period, with a constant outflow of investment funds, mostly to Britain, largely by way of absentee landlords [2. Cullen 1983, p. 31].

Numerous small so-called private banks were formed, mostly in Dublin, but also around the country, most notably Pike's Bank in Cork, Joyce & Co. in Galway city, Ffrench's Tuam Bank in Co. Galway, and others in Belfast, Waterford, Limerick and Clonmel [2. Cullen 1983], with many more throughout the country.

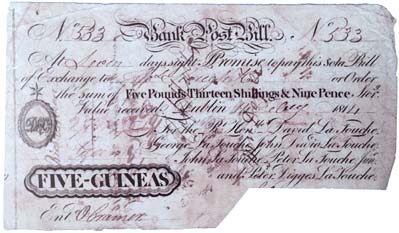

Most of these private banks failed, many of them within a few years of their formation. A few such as La Touche, however, were very successful in business [24, Fraser 1942-43; Dillon 1889, p.24]. All Irish banks were permitted to issue their own paper currency which took the form of banknotes and post bills. These currency issues were subject to a government stamp duty [1. Barrow, p.32].

In the second half of the eighteenth century private banks were prohibited by law from having more than six partners by the Bank of Ireland Act 1781 [24] which established the Bank of Ireland as a large private joint stock bank. Private banks were also required to have all of the partners of the bank named on every banknote, post bill, and receipt by the Act of 1756 [1. Barrow, p.12]. Additionally bankers were prohibited by this act from engaging in trade involving import or export. These restrictions excluded merchants from banking, and served to keep private banks small and weak. The economy was bound to suffer as a result.

The first attempt to redress the situation came with the foundation of the Bank of Ireland as a result of a petition to Parliament for an institution which would stimulate the Irish economy. The Bank was established by Royal Charter on 10 May 1783 [1. Barrow, p2.] and in return for a substantial loan to the Government it was granted the sole right of paper currency issue in Ireland, except for private banks of six partners or less, and was to be banker to the Government.

The Bank of Ireland was essentially a Central Bank, and was founded along the lines of The Bank of England and The Bank of Scotland. The bank commenced business on 25 June 1783, and proceeded to issue banknotes later that year [3. Hall 1949, p53].

For most of the 18th and early 19th centuries, there was a constant shortage of silver coinage in Ireland. This encouraged the widespread use of small notes, which were issued in varying denominations, by various merchants, businesses and private banks.

Small notes, those with a value of less than £5, were issued in denominations of pence, shillings, guineas and pounds. Their issue and usage was largely uncontrolled, and disapproved of by government, which sought to restrict them in an effort to control the perceived over-issue of paper money in Ireland.

The suspension of cash payments [8. Newby 2007] (i.e. gold) in 1797, due to England’s need for gold to finance its wars on the continent exacerbated this, by prompting banks to increase their small note issues.

It was after the suspension of cash payments in 1797 that banking and paper money became far more widespread in Ireland. This led to the growth of private banks, most of which issued their own notes.

The number of banks paying stamp duty on their notes was 11 in 1799, and had risen to 41 by 1803 [26. 1804 Report, Appendices D, H]. By 1820 there were approximately 28 banks in the country. The Bank of Ireland provided a stable currency for Dublin and its surrounding areas, which allowed the Dublin private banks to concentrate their activities on banking rather than note issue. The presence of the Bank of Ireland had a stabilising influence on these small banks.

Three new private banks were founded in Belfast city around 1808–1809: Gordon’s Belfast Bank in 1808, Montgomery’s Northern Bank in 1809, and Tennent’s Belfast Commercial Bank in 1809. They were to lay the foundations of future banking in Ulster. Each of the three banks opened a number of agencies throughout Ulster, and by 1826 there were 16 towns in the province with one or more agencies of these banks [1. Barrow, p.15]. The three banks were closely linked to the emerging industrial base in Ulster and provided a stable, reliable banknote issue. Only banknotes have been seen for these three banks — they appear to have not issued post bills.

In 1820, the rest of Ireland outside of Dublin and Ulster was very rural with little industry, and was served by just 14 banks plus one agency issuing notes [1. Barrow, p.16]. The banking crisis of May–June 1820 in which 7 of these banks folded within a two-week period, fatally wounded confidence in the paper money issues of the country private banks in the South, with about 80% of the total note circulation eventually proving to be worthless. Of the remaining banks, all but one had closed by 1829. This last bank, Delacour’s, finally closed in 1835. [1. Barrow, pp. 17-23].

All but one of the Dublin banks were supported by the Bank of Ireland with emergency loans during the 1820 crisis [1. Barrow, p19]. This enabled them to survive demands for payment on their notes. The Northern banks were supported strongly by local industry, and required only a minor degree of assistance from the Bank of Ireland [1. Barrow, p20].

However, the banking system in the rest of the country had been more or less left to its fate and allowed to collapse, due to a combination of sluggishness and disinterest on the part of the Bank of Ireland. Help, when it did arrive, was too little and too late. After lobbying by Cork merchants, the Bank of Ireland was authorised by Parliament to instigate a loan scheme to bail out suffering businesses in the South of the country. Over the course of the following few years, this alleviated much of the distress businesses were having in this region due to the banking crisis. Almost all of these loans were repaid in full [1. Barrow, pp21-23].

Bank of Ireland regarded itself as a banker to the government and as a provider of loans on government security, and did not consider the provision of a currency for general use as part of its duties. It did not issue banknotes outside of Dublin until 1824, and there was a shortage of currency in the country outside of the Dublin and Ulster areas in the years prior to this.

Post bills, which for security in transit purposes were payable some days after issue, usually 7, but up to 21, tended also to be used as currency as evidenced by endorsements seen on surviving examples [1. Barrow, p.30], as a compensation for the lack of banknotes in circulation.

Bank of Ireland did not issue any small notes of denominations under £5 until the suspension of cash payments in 1797 [1. Barrow, p.29], which sucked a lot of coinage out of circulation. Some private banks did issue small notes, and greatly increased their issues after this [27. O' Kelly, 1959, p.20].

The Irish economy remained in a state of severe depression in 1820 after the banking crisis, with a large and growing population, little useful employment available, and famine always in the shadows.

By contrast, in 1820 Scotland had a sound banking system. In the rest of the UK, including Ireland, banks were forced by law to be small and weak. Scotland had been allowed to develop along different lines. The Bank of Scotland’s special privileges had been abolished in 1716, and a strong joint stock banking system had evolved by 1826 when there were three large joint stock multi-branch banks and 29 other banks in Scotland [1. Barrow, p.61].

The need for reforms to the system outside of Scotland was recognised, and the proposed changes were to be tested first in Ireland. In February 1821, discussions were opened with the Bank of Ireland on the restriction of its privileges, in an effort to stimulate development in the banking sector [1. Barrow, p.61].

These discussions led to the Bank of Ireland Act 1821 [22], which permitted banks of greater than six partners to issue notes outside of a radius of 50 miles of Dublin - a distance that appears to have been fixed arbitrarily. Possibly, it might have been a reflection of The Pale of earlier times. These changes were agreed with the Bank of Ireland in return for some minor extensions of the bank’s business with the government. The bank retained a monopoly on note issue in Dublin.

There were a number of weaknesses in the act, which prevented it from having the effect of facilitating the creation of joint stock banks. Most significantly, no change had been made to the law governing the setting up of a bank (as laid out in the Act of 1756) which required all legal actions of the bank to be conducted in the names of all the partners of that bank, a very cumbersome requirement. The act also specified that the partners must be resident in Ireland, thus precluding the injection of English capital into Irish banks [1. Barrow, p.64].

The first lobbying for an improvement to the situation created by the 1821 Act came in March 1824, with a petition to Parliament on behalf of a group of Belfast businessmen and bankers seeking the repeal of the 1756 Act, so as to make the 1821 Act effective [1. Barrow, p.65].

The lack of large banks in Ulster was beginning to stifle further industrial expansion. The petition was considered by parliament, and after a brief examination of the effect that the proposal would have on the Bank of Ireland, and the dismissal of that bank’s objections to it, a bill was put forward which became law on June 17, as the Irish Banking Act, 1824 [20].

This act provided for banks of greater than six members, which could issue notes outside of a fifty mile radius of Dublin, provided that each bank registered annually, specifying the name of the officer under which it could sue and be sued, and the places of issue and of payment of its banknotes.

Note Issuing Banks

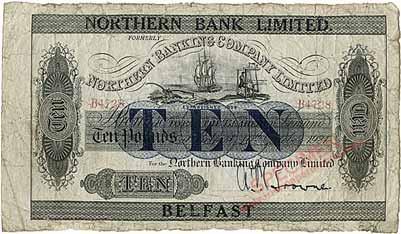

The Northern Banking Company was founded directly as a result of the 1824 act, when Montgomery's Northern Bank, a private bank based in Belfast, was converted into a private joint stock bank. The new bank commenced business on 1 January 1825. It issued banknotes that were payable at the branch of issue and at the bank’s head office in Belfast.

There were some ambiguities concerning the 1824 Act, the most significant of which was the question of English capital, not addressed at all in the act. A Newcastle on Tyne merchant, Thomas Joplin and a group of Irish MPs and others were promoting the idea of an Irish Provincial Banking Company, to serve mainly the southern part of the country, ignored by the existing banking system and still suffering from the effects of the banking crisis of 1820.

The proposal for the new bank relied heavily on English capital, and the uncertainties regarding this point needed to be addressed. This resulted in the Irish Banking Act, 1825 which resolved these problems by repealing the 1824 Act and specifically permitting members of banking partnerships to be resident anywhere in the United Kingdom.

By 1836, the Irish Banking Act, 1825 had led directly to the formation of five new Joint Stock note issuing banks; the Provincial Bank of Ireland (1825), the Belfast Banking Company (1827), the Agricultural & Commercial Bank of Ireland (1834), the National Bank of Ireland (1835) and the Ulster Banking Company (1836). The Belfast Banking Co. was formed from a merger of two existing private banks operating in Belfast, Tennent's and Gordon's.

All but one of these banks drew on English capital as well as Irish. The Agricultural & Commercial drew solely on Irish capital [1. Barrow, p109]. It was also the only Joint Stock note issuing bank which failed, due largely to a lack of liquidity.

Denominations Issued by Irish Joint Stock Banks

By 1836, seven banks were issuing notes in Ireland. The following denominations are known, from surviving banknotes, for each bank up to 1845:

Agricultural and Commercial Bank of Ireland: £1, 35 Shillings, £3, £5, £10

Bank of Ireland: 30 Shillings, £1, £3, £5, £10, £20, £50, £100, £200, £500. Others likely

Belfast Banking Company: £1, 25 Shillings, 30 Shillings, £5. Others likely.

National Bank of Ireland: £1, 30 Shillings, £3, £5, £10, £20, £50, £100.

Northern Banking Company: £1, 25 Shillings, 30 Shillings. Others likely.

Provincial Bank of Ireland: £1, 25 Shillings, 30 Shillings, £2, £3, £4, £5, £10, £20, £50, £100.

Ulster Banking Company: £1, 25 Shillings, 30 Shillings, 35 Shillings, £3 (recorded up to 1845), £5, £10, £20, £50, £100.

Hibernian Bank Tokens 1826-1827: £1, 30 Shillings, £3, £5, £20. Others likely

In addition, Bank of Ireland Series C notes for One Guinea (Type B, 1819) were issued up until around 1819.

An early proof One Guinea note is known for Northern Banking Company, ca1825.

The Agricultural and Commercial Bank of Ireland failed in 1840.

Fractional and Guinea denominations were prohibited by the 1845 act. In practice, the banks appear to have ceased issuing notes denominated in Guineas in the 1820s, and those denominated in Shillings had settled on 30 Shilling notes which were in widespread use

The denominations issued by the banks settled on the following up to 1920. £3 notes are known for four of the six banks:

Bank of Ireland: £1, £3, £5, £10, £20, £50, £100, £500. [Recorded notes]

Belfast Banking Company: : £1, £5, £10, £20, £50, £100. [Recorded notes. £100, BL].

National Bank of Ireland: £1, £3, £5, £10, £20, £50, £100. [Recorded notes. £50, £100: RBS].

Northern Banking Company: £1, £5, £10, £20, £50, £100. [Recorded notes].

Provincial Bank of Ireland: £1, £3, £5, £10, £20, £50, £100. [Recorded notes].

Ulster Banking Company: £1, £5, £10, £20, £50, £100. [Recorded notes. £50, £100: PMI].

Non-Note Issuing Banks

Several other Joint Stock banks were formed which did not issue their own notes, either because they chose not to do so, or because they were based in Dublin and were therefore prohibited from doing so by law. The most important of these were the Hibernian Bank (1825), and the Royal Bank of Ireland (1836). The Hibernian did issue Tokens for a short time, but desisted after objections from Bank of Ireland.

The next step was the unification of the Irish and English Pound. A proclamation of 1701 had fixed a value of One English silver shilling equal to thirteen Irish pence [4. Honohan, 2002], a par rate of 92.3% in favour of the English Pound. This had effectively linked the two currencies. Prior to this, the Irish currency, such as it was, had floated on its own.

However, in practice the exchange rate fluctuated. This was due in part to the overvaluation of gold, making the silver value in coins to exceed their face value and causing them to be pulled out of circulation. The 1717 reduction in the value of gold in England was not matched in Ireland until 20 years later, making the Irish pound cheaper by around 2.5%. Additionally, bills of exchange were used for foreign trade, and the rate of exchange for bills on the London market varied daily [4. Honohan, 2002].

With the suspension of cash payments in 1797, however, the actual rate fluctuated greatly on either side of this 92.3% par rate, the link being in effect broken by the removal of the gold standard, producing a degree of instability as a result.

The Act of Union in 1801 had abolished the Irish Parliament in Dublin and extended direct rule over Ireland by the English Parliament in London. Similarly the Assimilation of Currencies Act, 1825 [11] now provided for the abolition of the separate Irish currency altogether on 6 January 1826. Thereafter only English Sterling circulated in Ireland.

The gold standard was re-established on 1 May 1821. An Act of 1828 required banks to make their notes payable at the branch of issue, which was thereafter named on the notes along with the head office of the bank.

During the two decades from 1824 to 1844 a network of new banks and branches grew up across Ireland. The Bank of Ireland also established a branch network, opening its first branch in Cork in 1826.

During this period, the Provincial Bank of Ireland and National Bank of Ireland in particular both grew rapidly in strength and sought to compete with and challenge the Bank of Ireland. An Act of 1830 authorised banks of greater than 6 partners to redeem their banknotes within 50 miles of Dublin, but not to re-issue them. The twenty year period up to 1844 saw the gradual erosion of the special privileges of the Bank of Ireland, which the bank sought to protect.

In the early 1840s, a major reform of British monetary thinking led to the 1844 Bank Charter Act [12] in England, which placed limits on the quantity of notes that could be issued by any English bank other than the Bank of England. The aim was to control the quantity of notes in circulation in the interests of stability. Increases in the note issues of the Bank of England itself were to be fully backed by gold and silver reserves.

Following on from this new legislation in England, a consolidation of the system in Ireland took place with a new Irish regulatory act in 1844, which prohibited any new issuing banks and prevented the revival of a lapsed issuing bank. This paved the way for the Bankers (Ireland) Act 1845 [13]. The Royal Bank of Ireland and the Hibernian Bank had sought the right to issue notes just prior to this act, but were prohibited from doing so by reason of their location in Dublin, despite the imminent abolition of the Bank of Ireland’s privileges.

By the end of 1844, the Irish banks had 161 branches between them throughout Ireland. There followed a year later the Bankers (Ireland) Act 1845. It became law on 6 December 1845. This act was a substantial piece of legislation, the culmination of the 'experiment' of the previous twenty-five years, and a reflection of recent changes in England.

It fixed new regulations for note issues. Banks were allowed to issue an amount of money in their note issue up to a certified total, based upon their average issue over the previous 12 month period, their fiduciary issue, plus extra notes up to the value of their bullion holdings.

It forbade any newly-formed bank from acquiring the right of note issue, and most importantly made all banks equal in terms of their operations, abolishing Bank of Ireland’s special privileges. All banks of note issue were granted the right to issue and redeem banknotes throughout the entire country on an equal basis.

Fractional notes and Guinea denominations were prohibited. This precluded notes of 25 Shillings, 30 Shillings, and 35 Shillings, previously issued by several banks.

Although there was friction between the Bank of Ireland and the other banks at times, particularly with the Provincial Bank of Ireland over government business being transacted in Provincial notes, the second half of the 19th century saw the growth of the six banks into a sophisticated co-operative banking system with the banks accepting each other’s banknotes.

Several other Joint Stock Banks were formed in Ireland after 1845, but were precluded from acquiring the right of note issue under the 1845 act. The most important of these was the Munster & Leinster Bank, founded in 1885. It was the only Joint Stock bank founded in this period which survived in business intact to the 20th century, eventually becoming part of Allied Irish Banks in 1966.

In the early 20th century politics was to intervene and have a major influence on Irish banking and note issues.

The Rising of 1916 against British rule lead to the Irish War of Independence in 1919. The war resulted in a treaty, signed on 6 December 1921, which provided for the partition of the 32-county island into the 26-county Irish Free State and the 6-county Northern Ireland, which remained part of the UK. This was to have a huge effect on the banking system and on the paper money in circulation.

The constitution of the Irish Free State came into force on 6 December 1922. From this date, the Irish Free State arguably became independent of the British Empire.

Under the provisions of the 1845 Bankers (Ireland) Act, the Irish banks were required to secure all notes in circulation in excess of their fiduciary issue by an equal amount of gold and silver coin, such that the silver did not exceed one quarter of the gold in value.

Legal Tender

As a result of the emergency situation created by the outbreak of World War l, the Currency and Banknotes Act of 5 August 1914 [22] provided for the creation of British Treasury notes, which were to take the place of gold coin in circulation. These notes also circulated in Ireland. In 1920, these were the only Legal Tender Notes circulating in Ireland.

Irish banknotes had been made legal tender in Ireland in 1914 by the Currency and Banknotes Act, due to the war situation, with this status then being revoked at the end of 1919. The 1914 Act allowed the banks to substitute British currency notes for bullion, as cover for their excess note issues. All circulating notes, fiduciary and secured, were subject to a government stamp duty of 7 Shillings per £100 (0.35%) per annum.

In 1928, the Sterling unit of currency was the Pound, with main subdivisions as follows: One Pound = 20 Shillings, One Shilling = 12 Pennies, 1 Penny = 4 Farthings. This system prevailed until decimalisation in 1971 when the Pound was divided into 100 pence. With One Pound equal to 100 'new' pence, One Shilling then became equal to 5 'new' pence. Decimalisation took place on Decimal Day, Monday 15 February 1971.

The Irish currency was based on the exact same structure as that of Sterling and was linked to Sterling on a par basis from its inception in 1928 up to Ireland’s entry into the European Exchange Rate Mechanism (ERM) on 13 March 1979. Then, the link with Sterling was broken and the Irish Pound became linked loosely to a basket of EC currencies [5. Honohan & Murphy 2010].

Because of the link to Sterling, Ireland adopted a similar decimal currency at the same time as Britain. Sterling coin and notes—Bank of England, Northern Ireland issues, occasionally Scottish, and notes of the islands—always circulated freely in Ireland in small quantities until the termination of the link.

Sterling had been legal tender in Ireland since 1826, after the Assimilation of Currencies Act, 1825. After Irish independence in 1921 the Sterling banknotes of the Irish banks continued to circulate throughout the island of Ireland, as did English currency.

The British and Irish Governments had made an informal agreement in 1923 to divide the stamp duty on circulating notes as follows: the Government of Northern Ireland would collect the duty on banknotes of the Northern, Ulster and Belfast Banks, whilst the Government of the Irish Free State would collect the duty on the notes of the Bank of Ireland, the Provincial and National banks. This measure served to avoid double taxation of the banks’ note issues.

However, during the 1920s, the need for a distinctive Irish currency and an authority to control its issue became apparent. A Banking Commission was appointed on 8 March 1926 by the Minister for Finance, Ernest Blythe, to study the matter. The Banking Commission consisted of eight persons; six bankers, one civil servant and a Chairman, one Professor Henry Parker Willis, of Colombia University, New York, USA.

The Banking Commission sat for nine months, issuing four interim reports and one final report. It recommended the establishment of a currency commission in the Irish Free State, to issue and regulate a new currency, the Saorstát Pound, which would be linked at parity to the British Pound Sterling [6. Honohan 1997]. The Banking Commission’s recommendations lead to the 1927 Currency Act [15].

The currency circulating in Ireland changed radically with the provisions of the 1927 act. The Currency Commission was created and commenced the issue of Legal Tender Notes in 1928. In 1929, the Associated (Irish Joint Stock) Banks’ issues on the island of Ireland were split into Consolidated Banknotes, controlled by the Currency Commission (a system similar to the Federal Reserve System in the US) in the Irish Free State, and a new Northern Ireland Issue issue for Northern Ireland. This Partition of Irish Currencies would lead to new issues for all the note-issuing banks, and the withdrawal of all banknotes then in circulation.

Agreement on Taxation of Note Issues and the Apportioning of the Existing Banknotes in Circulation

The agreement on the collection of duty on notes continued up to the establishment of the Currency Commission and the intention of replacing all notes of the banks with the new issue of Consolidated Notes in the Irish Free State on an appointed day.

The duty on existing (to become old) notes became a bone of contention at this point. There was considerable debate between the two governments over how to divide up the responsibility for the banknotes already in circulation.

Originally it was proposed by Joseph Brennan (Later Chairman of the Currency Commission and first Governor of the Central Bank of Ireland) that the entirety of the banknotes issued by banks with their head office in Dublin (Bank of Ireland) and London (Provincial and National) would be apportioned to the Irish Free State, with those notes of the banks with their head office in Belfast (Northern and Ulster) being apportioned to Northern Ireland. The Belfast Banking Co. having withdrawn from operations outside of Northern Ireland automatically had 100% of its notes apportioned to Northern Ireland.

Mr. Brennan’s suggestion was found to be unacceptable to the British Government, and instead it was agreed that the outstanding notes of the five banks operating in both jurisdictions were to be divided in relation to the banks' operations in each.

The percentages of circulating banknotes allocated to the Irish Free State were as follows [7. Moynihan 1975, p. 160]:

Bank of Ireland 87%

The National Bank 95%

The Northern Bank 28%

The Provincial Bank of Ireland 82%

The Ulster Bank 42%

This made up 71% of the total circulation in Pounds of the five banks.

For the purpose of taxation on note issues in the Irish Free State, the proportion of old notes appertaining to the State which were still outstanding on the appointed day, 6 May 1929, for each of the banks, were counted as part of the Consolidated Bank Note issue for that bank and would be taxed at 1.5% per annum, the same rate as applied to consolidated notes.

A higher tax was to be levied on any old notes extant greater than half of the bank’s allocation of Consolidated Bank Notes. These old notes outstanding which exceeded the limit permitted would be subject to a tax of 3% for the first year and 5% p.a. thereafter. A provision was also fixed for a sliding taxation scale of 5%, rising to a maximum of 10.5% p.a. for an extraordinary issue of Consolidated Banknotes above a bank’s limit.

The Bankers’ Northern Ireland Bill [16] fixed the provisions for the creation of the Northern Ireland Issue in place of the all-Ireland issue of the Irish banks. It became law on 2 July 1928.

A provision of the Act was that it would not come into effect until after the appointed day for the currency changeover, a date to be fixed by the Currency Commission. This created the curious situation in that a piece of British legislation would not become law until an Act of Parliament was passed outside of British jurisdiction.

New fiduciary limits were fixed for the banks based upon their size and assets within Northern Ireland, with a requirement of security in British Treasury and Bank of England notes for any notes in circulation in excess of these limits. However, the provisions of the act made it clear that the entire number of notes in circulation exceeding the fiduciary limit, whether appertaining to the Irish Free State or to Northern Ireland, would have to be backed by security in British currency.

This requirement, when enforced, would place a significant hardship on the banks for as long as their own old notes circulated in the Irish Free State after the appointed day. They would be required to be backed by British security, whilst also being treated as Consolidated Banknotes by the Currency Commission, and taxed accordingly by the Irish Government.

The bill was amended to allow for a period of grace after the appointed day for the banks to have time to reduce their circulation to the new fiduciary limits before the requirements for securing notes were to come into effect. This double burden rapidly decreased as the old notes of the banks were withdrawn and replaced by Consolidated Bank Notes.

The double tax burden did not disappear, however, in the case of dead notes, those which would never be presented for payment due to being irretrievably lost or destroyed. Joseph Brennan identified this question early on as being a major bone of contention.

In 1929, the banks sought to write off a certain portion of their notes as dead, and cease payment of stamp duty on them. This was not permitted by either government at the time. The question of dead notes was not resolved.

Section 40 of the Central Bank Act, 1942, provided for the conditional possibility of the writing off of dead notes at the request of the bank concerned, should the request be deemed to be appropriate. As of February 1974 no such request had ever been made [7. Moynihan 1975, p. 166]. Subsequent to this date information is not available in relation to this interesting topic.

The banknote issues of all of the joint Stock Banks (referred to throughout as Old Notes, the Central Bank of Ireland term for banknotes of the Associated Banks which are still redeemable at their face value) except the Bank of Ireland were of a generally similar standard design and were printed in England.

The Bank of Ireland’s notes were different, and from early on were printed by the bank itself in Dublin. There were three major design changes, the last being in 1838 with the introduction of the classic design featuring a row of Mercury heads along the top of each note. This basic design then remained unchanged for 120 years.

Banknotes of the Belfast Banking Company were printed on both sides since 1879, and those of the Northern since 1907. Those of the other banks remained uniface until the early 20th century, with reverse printing introduced as follows: Bank of Ireland, 1922; Provincial, 1920; National, 1920; Ulster, 1935.

The 1828 Bank Notes (Ireland) Act, which became operative on 1 April 1829, required banknotes to be payable at the branch of issue, and therefore the place name, usually the name of the town where the issuing branch was located had to be stated on each note from this time on. This was a somewhat cumbersome printing process.

Mulitbranch notes

The earliest appearance of a multi-branch banknote design, with more than one branch listed on each note, was in 1831 on some notes of the Bank of Ireland.

The first multi-branch General Issue notes, those listing all the branches of a bank on every note, appeared in the 1850s with the branch names as add-ons to the existing basic banknote design. The earliest recorded example of a multibranch banknote is an Ulster Banking Company One Pound note, dated 1 July 1852.

All of the banks introduced multibranch notes over the following two decades. The multibranch notes of the three Northern banks listed two main offices from the mid-1880s on, Belfast and Dublin, although Belfast retained head office status. The other banks listed only Dublin as the principal office of payment.

The multibranch banknote designs appear to have been a device to facilitate a reduction in the costs of printing, enabling more generic note designs to be used, and facilitating more widespread usage of the notes themselves. As new branches were established, they were added to notes, sometimes as overprints. The plates of each denomination were re-engraved periodically to include new branches in the main branch listings. This system has produced many branch sub-varieties for some of the banks.

Bank branch listings removed from notes

The Banknotes (Ireland) Act 1920 [14] removed the requirement on the banks to redeem their notes at the branch of issue, requiring payment only at the principal office of each bank. It was therefore no longer necessary to state the branch of issue and payment on the note, and branch listings disappeared from notes of all the banks. Thus, the multibranch banknote designs came to an end.

This happened around the same time as the banks were updating their note designs, resulting in a largescale transition of Irish currency notes to more modern designs as all the banks followed the trend.

The issuing banks all produced new General Note Issue designs as a result of the 1920 Act. Most of the banks had already begun to reduce the size of their £1 notes. The National Bank, in a very modernist move, made all of its notes smaller sized. Small-sized notes of the National Bank, Provincial Bank and Bank of Ireland appear both with and without branch listings.

Bank of Ireland introduced a new series in 1922, with all denominations being printed on both sides, as did the Belfast Banking Company. £1 notes of the Northern, Provincial and Ulster banks were also reduced in size, with the Provincial £1 notes being printed on both sides for the first time. All denominations of the National’s post multi-branch notes were printed on both sides and were all of a similar size.

With the exception of the National Bank, the Belfast Banking Company, and the Provincial Bank, each of which produced completely new designs for their Northern Ireland Issue, all of the other banks’ Northern Ireland notes were almost identical in design to the previous all-Ireland old note issues. The principal differences were a new serial prefixing system and Belfast being substituted as the principal office of payment in place of Dublin.

The Northern and Ulster banks each produced an initial issue of overprinted notes on an all-Ireland design, in order to use up stocks of previously printed notes. The Ulster Bank 1929 overprinted series consisted of £1 notes only and were rapidly used up. The Northern Bank 1929 overprinted series was more extensive, spanning across most denominations. It appears that the £50 and £100 note overprints were issued periodically up to the end of the 1960s. Examples are relatively easy to obtain.

The Currency Act 1927 resulted from the Banking Commission’s recommendations. It became law on 20 August 1927. The Act provided for the establishment of a Currency Commission as an independent non-political body which would control and manage the new Irish currency, the 'Saorstát Pound'.

The Currency Commission was granted power to issue Legal Tender Notes, in denominations of 10 Shillings, £1, £5, £10, £20, £50, and £100. The first issue date of each denomination of these notes was 10.9.28. They entered circulation on this date of issue. The notes were signed by Joseph Brennan as Chairman of the Currency Commission, and J. J. McElligott as Secretary of the Department of Finance. The design later became termed as the A Series, or Series A.

In accordance with the Banking Commission’s recommendations, the Saorstát Pound was linked to Sterling to ensure the former’s stability, and was exchangeable at par with Sterling. Although the Irish currency was not legal tender in the UK, it circulated to a very small degree in Northern Ireland.

With regard to the fact that some of the commercial banks had their own note issues in use, all of the joint stock circulation banks were admitted as share-holding banks (known as the Associated Banks) of the Currency Commission. The right of note issue of the commercial banks was retained, though at reduced levels and with the inclusion of a greater number of banks. The Consolidated Banknote issue was created to facilitate this purpose.

These notes were not Legal Tender, but payable in Legal Tender Notes on demand. The notes were of a standard overall design differing only in the title of the bank of issue and a prefix identifying that issuing bank. The initial total aggregate of the Consolidated Banknotes was not to exceed £6,000,000 in value, with the outstanding amount of old notes of the banks included in this total. The appointed day for their introduction was 6 May 1929.

Three banks, the Hibernian, the Munster & Leinster, and the Royal Bank of Ireland, issued banknotes bearing their own names for the first time on 6 May 1929. Each banknote was signed by Joseph Brennan as Chairman of the Currency Commission, and by a second signatory for the bank of issue.

The existence of the Consolidated Banknote issue is a testament to the power held by the commercial banks at the time and the fact that they provided the country with a currency. However, it was always envisaged that the State would eventually remove the right of note issue from these banks. The Consolidated Bank Note issue served as a means to this end.

A second Banking Commission was appointed in November 1934, to consider the situation of banking within the Irish State. It published its final report in 1938. The most important of its recommendations was that a Central Bank with greater powers be established in place of the Currency Commission. Also, it recommended a cessation of the right of note issue for the Associated banks, which would mean the end of the Consolidated Banknote issue.

The Central Bank Act 1942 [17], resulted from the recommendations of the second Banking Commission. It terminated the Currency Commission, transferring its assets, liabilities, and responsibilities to the new authority, the Central Bank of Ireland, which formally came into being on 1 February 1943.

The basic design of Legal Tender Notes was not altered except for the title of the new Issuing Authority, 'The Central Bank of Ireland' which replaced that of 'Currency Commission Ireland' on the top of each banknote.

The issue of Consolidated Bank Notes was terminated on 31 December 1953. The amounts of Consolidated notes in use by the Associated Banks had always been less than the permitted total, due to pre-partition old notes being outstanding.

The quantity of Consolidated Bank Notes in existence on 31 December 1953 was £620,191. This was considerably less than the total permitted aggregate at the time, which was £1,299,000.

The Associated Banks permitted aggregate was gradually reduced over three year periods. It reached zero on 31 December 1956. As of that date, the Central Bank of Ireland had sole right of note issue, and all of the Consolidated Bank Notes were to be withdrawn from circulation by 1 January 1957, when the Central Bank of Ireland would acquire responsibility for the outstanding notes.

On 31 March 1954, six of the Associated Banks paid amounts equalling their total outstanding Consolidated notes, including old notes, to the Central Bank. This totalled £400,422. The remaining two banks (the Bank of Ireland and the Provincial Bank of Ireland) paid up the total amount of their outstanding notes by the end of 1956, totalling £140,399.

The Central Bank of Ireland continues to redeem the Consolidated Bank Notes at their face value as they are presented.

1976 saw the introduction of B Series Legal Tender Notes, starting with the £5 denomination, which replaced the A Series on a phased basis, a process completed when the B Series £50 note entered circulation in 1982.

Although a design for the B Series £100 note denomination was prepared, it was cancelled shortly before production and the A Series £100 remained in use.

Sixteen years later, in 1992, the C Series Legal Tender Notes were introduced, starting with the £20 denomination. The new design replaced the B Series on a phased basis over the following four years, culminating in the introduction of a new £100 note in 1996.

On 31 December 1998 the EU single currency, the Euro, came into being when eleven (Austria, Belgium, Germany, Finland, France, Ireland, Italy, Luxembourg, Portugal, Spain and The Netherlands) of the fifteen EU countries merged their currencies, by locking their exchange rates with respect to each other (A twelfth, Greece joined later).

The Irish Pound became locked at a value of 1 Euro equal to IR£0.787564. Euro banknotes and coins replaced national currencies in circulation on 1 January 2002.

The European Central Bank has control over the Euro, and the Issuing Authorities of the member countries became offices of the European Central Bank. With the replacement of the Irish Pound [4] in circulation by the Euro, there is no fixed date for the demonetisation of old Irish Legal Tender Notes, and all notes issued by the Joint Stock banks and the Currency Commission and Central Bank of Ireland are redeemable at their face value.

Banknotes issued in Northern Ireland by the Irish banks are regulated by the Bank of England and are not part of the Euro zone currencies.

Continue to a pictorial Historical Timeline of Irish Paper Money - 28 Pages

References

1. Barrow, G. L. 'The Emergence of the Irish Banking System 1820–1845', Gill & Macmillan, 1975.

2. Cullen, L. M. (1983). 'Landlords, bankers and merchants: the early Irish banking world', 1700-1820. Hermathena, 135, 25–44. <http://www.jstor.org/stable/23040820> [Last accessed 27.11.21]

Hall, F.G., 'The Bank of Ireland 1783-1946', Hodges Figgis, Dublin, 1949.

Honohan, P., (Spring 2002). 'Farewell to the Irish Pound', History Ireland Magazine, v10, No. 1. <https://www.historyireland.com/20th-century-contemporary-history/using-other-peoples-money-farewell-to-the-irish-pound/> [Last accessed 27.11.21]

Honohan, P., Murphy, G., (2010). 'Breaking the Sterling Link: Ireland's Decision to Enter the EMS' <https://www.researchgate.net/publication/242570311_Breaking_the_Sterling_Link_Ireland%27s_Decision_to_Enter_the_EMS> [Last accessed 27.11.21]

Honohan, P., (1994). 'Currency Board or Central Bank? Lessons from the Irish Pound's Link with Sterling, 1928-79' <http://homepage.eircom.net/~phonohan/BNL.pdf> [Last accessed 27.11.21].

Moynihan, Dr M. 'Currency and Central Banking in Ireland 1922–1960', Gill & Macmillan and The Central Bank of Ireland, 1975.

Newby, E. (2007). 'The Suspension of Cash Payments as a Monetary Regime', University of St Andrews. <https://www.st-andrews.ac.uk/~wwwecon/CDMA/papers/wp0707.pdf> [Last accessed 07.10.23]

Share, B., Ed. 'Root and Branch. Allied Irish Banks. Yesterday, Today, Tomorrow', AIB, Dublin, 1979.

Smyth, G. L. 'Ireland: Historical and Statistical', Vol 3, Whitaker, London, 1849.

Walsh, P. 'The South Sea Bubble and Ireland: Money, Banking and Investment, 1690–1721', Boydell Press, Woodbridge, 2014.

Referenced Acts of Parliament

Assimilation of Currencies Act (1825). <https://books.google.co.uk/books?id=Il80AQAAMAAJ&pg=PA367&lpg=PA367&dq> [Last accessed 27.11.21]

A parliamentary brief on the Assimilation of Currencies Act, 1825. <https://api.parliament.uk/historic-hansard/commons/1825/may/12/assimilation-of-the-currencies-of-great> [Last accessed 27.11.21]

1844 Bank Charter Act <https://www.legislation.gov.uk/ukpga/Vict/7-8/32/contents/enacted> [Last accessed 27.11.21]

Bankers (Ireland) Act 1845 <https://www.irishstatutebook.ie/eli/1845/act/37/enacted/en/print> [Last accessed 27.11.21]

Banknotes (Ireland) Act 1920. <https://www.legislation.gov.uk/ukpga/Geo5/10-11/24/enacted> [Last accessed 27.11.21]

Currency Act (1927). <https://www.irishstatutebook.ie/eli/1927/act/32/enacted/en/html?q=currency+act&years=1927> [Last accessed 27.11.21]

Bankers Northern Ireland Bill (1928). <https://api.parliament.uk/historic-hansard/lords/1928/jun/07/bankers-northern-ireland-bill> [Last accessed 27.11.21]

Central Bank Act (1942). <https://www.irishstatutebook.ie/eli/1942/act/22/enacted/en/html> [Last accessed 27.11.21]

For Promoting Public Credit (1756). 29 Geo ii c.16., Royal Assent 8 May 1756.

Bank of Ireland Act (1821). <https://www.irishstatutebook.ie/eli/1821/act/72/enacted/en/print.html> [Last accessed 10.10.22]

Bank of Ireland Act 1821

<https://www.irishstatutebook.ie/eli/1821/act/72/enacted/en/print.html>

Currency and Banknotes Act, 1914.

<https://www.gold.org/sites/default/files/documents/1914aug6.pdf> [Last accessed 10.10.22]

Fraser, A. M. (Dec., 1942 - Feb., 1943). David Digues La Touche, Banker, and a Few of His Descendants. Dublin Historical Record, 5(2), pp. 55-68.

Bank of Ireland Act (1781)

<https://www.irishstatutebook.ie/eli/1781/act/16/enacted/en/print.html> [Last accessed 13.10.22]

1804 Report. A parliamentary paper of 1804, titled 'Report,Minutes of Evidence, and Appendix from the Committee on the Circulating Paper, the Specie and the Current Coin of Ireland; and Also on the Exchange Between That Part of the United Kingdom and Great Britain 1804'

O’Kelly, E. (1959). 'The Old Private Banks and Bankers of Munster'. Cork: Cork University Press.

Bills of Exchange and Promissory Notes (1709). 8 Anne, c.11 url <https://www.qub.ac.uk/ild/?func=display_bill&id=1201> [Last accessed 22.02.23]

General References and Sources

A. Blake, B., Callaway, J. 'Paper Money of Ireland', 2009.

B. Mac Devitt, M. 'Irish Banknotes. Irish Government Papermoney from 1928', Whytes, Dublin, 1999.

C. Mac Devitt, M. 'Irish Banknotes. Irish Paper Money 1783–2005', Seachran, Dublin, 2005.

D. Royal Bank of Scotland Archive, Edinburgh (RBOS).

E. British Library, London (BL).

Special Sections and Articles

The Transition of Irish Currency, Irish banknotes 1918–1928

The Partition of Irish Currency, Irish banknotes 1928–1930

Banknote Design Evolution 1824 to 1916

Irish Three Pound Notes

Contemporary Forgeries of Early Irish Banknotes, ca1800-1930

Limerick Soviet Notes

Irish World War 2 Banknote Issues

Low Number Irish Banknotes

Irish Joint Stock Banks of Note Issue from 1783

Irish Legal Tender Note Specimens

Ploughman Scan Survey (PSS)

1 Pound Ploughman

5 Pounds Ploughman

10 Pounds Ploughman

20 Pounds Ploughman

50 Pounds Ploughman

100 Pounds Ploughman

Irish Ten Shilling Notes

1 Pound Note Lady Lavery

5 Pounds Lady Lavery

10 Pounds Lady Lavery

20 Pounds Lady Lavery

50 Pounds Lady Lavery

100 Pounds Lady Lavery

1 Pound Note, Queen Medb

5 Pound Note, John Scotus Eriugena

10 Pound Note, Jonathan Swift

20 Pound Note, W. B. Yeats

50 Pound Note, Turlough O'Carolan

100 Pound Note, Grace O'Malley

5 Pound Note, Sister Catherine McAuley

10 Pound Note, James Joyce

20 Pound Note, Daniel O'Connell

50 Pound Note, Douglas Hyde

100 Pound Note, Charles Stewart Parnell

![]() Working version, under revision. Last update 07.08.24

Working version, under revision. Last update 07.08.24